How to invest in physical gold. The complete guide.

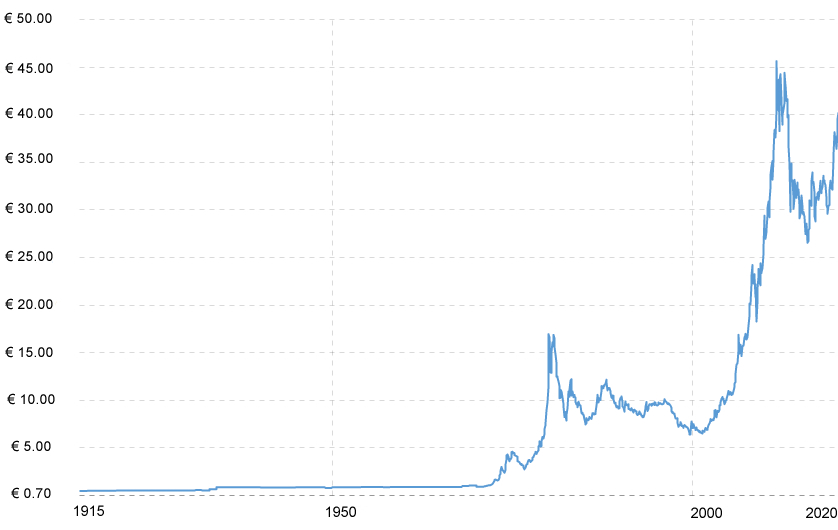

Gold is considered by investors to be the safest investment par excellence because since ancient times its value has always been on the rise, as can be seen in the graph below:

Source: www.macrotrends.net

So referring to historical data, it is found that gold is undoubtedly one of the best long-term investments. Because looking at the graph you can see that from 1915 to 2020, the price has always increased gradually over the years.

So, if we had purchased a 1 kg gold ingot in 2000 when its value was around €9,000.00 and sold it in 2020, its value would have increased by +440% , i.e. € 48,600.00 in value with a profit of €39,600.00. Not a bad investment...

However, it is important to point out, as explained previously, that gold must be considered a long-term investment because if, hypothetically, we purchased a 1 kg ingot in 2011, its purchase price was €46,000.00 but observing the graph, it can be seen that from 2011 to 2020 the price collapsed drastically until it reached € 27,000.00 , therefore for 9 long years we would have lost our money, that is, the monetary value in euros of €19,000.00.

Therefore investing in gold is not a 100% safe investment. However, observing its performance over history, it is easy to see that it is still one of the best investments, because since ancient times its value has gradually grown .

And another very important aspect that is considered by investors is that gold does not undergo devaluation, unlike money.

Because those who possess monetary resources are at constant risk of devaluations also due to inflation and therefore regularly lose purchasing power over the years.

This is why gold is also called a "safe haven" .

How to invest in physical gold

It is possible to invest in physical gold by purchasing bars and/or coins.

By clicking on the following link you can find out about all the companies specialized in the marketing of investment gold accredited by the Bank of Italy:

https://infostat.bancaditalia.it/GIAVAInquiry-public/oro.html

First of all, it is important to clarify that the purchase and sale and possession of investment gold exceeding 1 gram, with a fineness of 995% and 999% and coins that have a purity/fineness equal to or greater than 900 thousandths which were minted after 1800, are exempt from VAT pursuant to art. 10 number 11 of DPR 633/72 .

Therefore, to proceed with the purchase of physical investment gold, you will need to contact these companies, communicate your desire to purchase via email or telephone and accept the general conditions of sale proposed by the company.

The conclusion of the purchase contract will take place following the buyer's acceptance of the estimate provided by the company, with the consequent freezing of the price (which will remain unchanged regardless of future price fluctuations) of the goods purchased.

And subsequently it will be necessary to proceed with the payment of the purchased goods by bank transfer.

Delivery will take place via couriers specialized in the transport of precious items. And the shipping is insured , so the buyer is totally free from any risk . Delivery can also be made to banks or safes.

How to sell physical gold for investment

For resale, you can contact the companies selling physical investment gold directly.

The procedure for resale is as follows:

The goods being sold must be sent to the purchasing company, via a courier specialized in the transport of precious stones; the transport can also be managed by the purchasing company, which, upon arrival of the goods, will examine the presence of all the quantitative requirements and gold quality.

Subsequently, the purchasing company will proceed with sending the estimate to the customer and sending the contractual conditions.

Once the quote has been accepted and the countersigned contractual conditions have been delivered, the purchasing company will proceed to the official setting of the price which will remain so regardless of future price fluctuations until the order is concluded.

Finally, he will pay for the goods purchased by bank transfer.

Taxation on investment gold

As we have already explained previously, both the purchase and possession of physical gold for investment are exempt from VAT , however in the event of resale of the goods, the capital gains tax will have to be paid.

The capital gain is the difference between the purchase price and the resale price. So let's say you bought an ingot for €1000 and resold it for €1500, the capital gain will be €500.

Therefore according to Italian law you will have to pay the substitute tax of 26% on €500.

The capital gain is ascertained from the purchase invoice of the goods being resold, but if you are not in possession of the purchase invoice, the tax authorities assume that there has been a capital gain of 25% on the resale price.

So it is easy to understand that it is essential to keep the purchase invoice, because if we assume there was a capital loss on the resale, the taxman still calculates a 25% positive profit . However, the payment of the substitute tax of 26% on the 25% profit must be added.

So it would be a big problem if we had too much gold to resell.

While if at the time of resale, there is a capital loss ascertained by the purchase invoice, the substitute tax will not be due.

We also remind you, if you need to purchase a jewel entirely in 18 Kt gold, rely on the Specialists!

Comments

mar 4, 2026

mar 4, 2026

mar 3, 2026

mar 3, 2026

mar 2, 2026

mar 1, 2026

feb 21, 2026

feb 20, 2026

feb 17, 2026

feb 17, 2026

feb 17, 2026

feb 17, 2026

feb 16, 2026

feb 15, 2026

feb 9, 2026

feb 9, 2026

feb 8, 2026

feb 8, 2026

feb 8, 2026

feb 6, 2026

feb 1, 2026

gen 27, 2026

gen 26, 2026

gen 25, 2026

gen 25, 2026

gen 25, 2026

gen 25, 2026

gen 25, 2026

gen 22, 2026

gen 21, 2026

gen 21, 2026

gen 20, 2026

gen 14, 2026

gen 11, 2026

gen 11, 2026

gen 11, 2026

gen 10, 2026

gen 10, 2026

gen 9, 2026

dic 28, 2025

dic 27, 2025

dic 26, 2025

dic 20, 2025

dic 19, 2025

dic 17, 2025

dic 14, 2025

dic 13, 2025

dic 10, 2025

dic 9, 2025

dic 8, 2025

dic 7, 2025

dic 7, 2025

dic 7, 2025

dic 7, 2025

dic 7, 2025

dic 6, 2025

dic 5, 2025

dic 5, 2025

dic 4, 2025

dic 4, 2025

dic 2, 2025

dic 2, 2025

dic 2, 2025

dic 1, 2025

nov 29, 2025

nov 28, 2025

nov 28, 2025

nov 23, 2025

nov 17, 2025

nov 13, 2025

nov 12, 2025

nov 12, 2025

nov 11, 2025

nov 11, 2025

nov 10, 2025

nov 10, 2025

nov 6, 2025

nov 5, 2025

nov 4, 2025

nov 2, 2025

ott 31, 2025

ott 30, 2025

ott 28, 2025

ott 27, 2025

ott 25, 2025

ott 24, 2025

ott 24, 2025

ott 24, 2025

ott 24, 2025

ott 24, 2025

ott 22, 2025

ott 22, 2025

ott 20, 2025

ott 19, 2025

ott 17, 2025

ott 17, 2025

ott 16, 2025

ott 16, 2025

ott 15, 2025

ott 12, 2025

ott 10, 2025

ott 7, 2025

ott 5, 2025

ott 3, 2025

set 29, 2025

set 29, 2025

set 26, 2025

set 26, 2025

set 24, 2025

set 23, 2025

set 23, 2025

set 23, 2025

set 20, 2025

set 20, 2025

set 17, 2025

set 8, 2025

set 2, 2025

set 2, 2025

set 1, 2025

set 1, 2025

ago 31, 2025

ago 31, 2025

ago 30, 2025

ago 29, 2025

ago 28, 2025

ago 24, 2025

ago 23, 2025

ago 22, 2025

ago 21, 2025

ago 17, 2025

ago 13, 2025

ago 6, 2025

ago 1, 2025

ago 1, 2025

lug 18, 2025

lug 17, 2025

lug 7, 2025

lug 7, 2025

lug 5, 2025

lug 1, 2025

giu 28, 2025

giu 26, 2025

giu 24, 2025

giu 19, 2025

giu 19, 2025

giu 19, 2025

giu 14, 2025

giu 14, 2025

giu 14, 2025

giu 11, 2025

giu 8, 2025

giu 8, 2025

giu 8, 2025

giu 8, 2025

giu 4, 2025

mag 30, 2025

mag 30, 2025

mag 29, 2025

mag 29, 2025

mag 29, 2025

mag 29, 2025

mag 29, 2025

mag 29, 2025

mag 27, 2025

mag 27, 2025

mag 27, 2025

mag 27, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 26, 2025

mag 25, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 24, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 23, 2025

mag 22, 2025

mag 22, 2025

mag 22, 2025

mag 22, 2025

mag 21, 2025

mag 21, 2025

mag 21, 2025

mag 21, 2025

mag 20, 2025

mag 20, 2025

mag 19, 2025

mag 19, 2025

mag 18, 2025

mag 18, 2025

mag 17, 2025

mag 17, 2025

mag 17, 2025

mag 17, 2025

mag 16, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 15, 2025

mag 14, 2025

mag 13, 2025

mag 13, 2025

mag 12, 2025

mag 12, 2025

mag 12, 2025

mag 12, 2025

mag 12, 2025

mag 11, 2025

mag 11, 2025

mag 11, 2025

mag 11, 2025

mag 10, 2025

mag 9, 2025

mag 9, 2025

mag 8, 2025

mag 8, 2025

mag 8, 2025

mag 6, 2025

mag 6, 2025

mag 6, 2025

mag 5, 2025

mag 5, 2025

mag 5, 2025

mag 5, 2025

mag 4, 2025

mag 4, 2025

mag 4, 2025

mag 4, 2025

mag 4, 2025

mag 3, 2025

mag 3, 2025

mag 3, 2025

mag 3, 2025

mag 3, 2025

mag 2, 2025

mag 2, 2025

mag 2, 2025

mag 2, 2025

mag 2, 2025

mag 2, 2025

mag 2, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

mag 1, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 30, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 29, 2025

apr 28, 2025

apr 27, 2025

apr 27, 2025

apr 26, 2025

apr 26, 2025

apr 26, 2025

apr 24, 2025

apr 24, 2025

apr 24, 2025

apr 24, 2025

apr 23, 2025

apr 23, 2025

apr 23, 2025

apr 23, 2025

apr 23, 2025

apr 22, 2025

apr 22, 2025

apr 22, 2025

apr 22, 2025

apr 22, 2025

apr 20, 2025

apr 20, 2025

apr 20, 2025

apr 20, 2025

apr 20, 2025

apr 19, 2025

apr 19, 2025

apr 19, 2025

apr 19, 2025

apr 19, 2025

apr 18, 2025

apr 18, 2025

apr 18, 2025

apr 18, 2025

apr 15, 2025

apr 12, 2025

apr 10, 2025

apr 6, 2025

apr 6, 2025

apr 6, 2025

apr 6, 2025

apr 6, 2025

apr 6, 2025

apr 5, 2025

apr 5, 2025

apr 5, 2025

apr 5, 2025

apr 4, 2025

apr 4, 2025

apr 4, 2025

apr 1, 2025

apr 1, 2025

mar 31, 2025

mar 31, 2025

mar 30, 2025

mar 30, 2025

mar 30, 2025

mar 30, 2025

mar 29, 2025

mar 29, 2025

mar 29, 2025

mar 29, 2025

mar 28, 2025

mar 28, 2025

mar 26, 2025

mar 25, 2025

mar 25, 2025

mar 25, 2025

mar 25, 2025

mar 25, 2025

mar 24, 2025

mar 21, 2025

mar 21, 2025

mar 20, 2025

mar 19, 2025

mar 17, 2025

mar 16, 2025

mar 15, 2025

mar 15, 2025

mar 15, 2025

mar 11, 2025

mar 11, 2025

mar 11, 2025

mar 9, 2025

mar 4, 2025

mar 3, 2025

mar 3, 2025

mar 2, 2025

feb 28, 2025

feb 27, 2025

feb 24, 2025

feb 24, 2025

feb 24, 2025

feb 23, 2025

feb 22, 2025

feb 21, 2025

feb 21, 2025

feb 21, 2025

feb 20, 2025

feb 20, 2025

feb 20, 2025

feb 20, 2025

feb 20, 2025

feb 19, 2025

feb 18, 2025

feb 16, 2025

feb 16, 2025

feb 15, 2025

feb 15, 2025

feb 15, 2025

feb 15, 2025

feb 15, 2025

feb 15, 2025

feb 11, 2025

feb 10, 2025

feb 10, 2025

feb 10, 2025

feb 10, 2025

feb 9, 2025

feb 9, 2025

feb 8, 2025

feb 8, 2025

feb 8, 2025

feb 4, 2025

feb 3, 2025

feb 3, 2025

feb 3, 2025

feb 2, 2025

gen 30, 2025

gen 26, 2025

gen 23, 2025

gen 20, 2025

gen 19, 2025

gen 14, 2025

gen 12, 2025

gen 10, 2025

gen 10, 2025

gen 9, 2025

dic 11, 2024

dic 9, 2024

dic 7, 2024

dic 4, 2024

dic 1, 2024

nov 30, 2024

nov 29, 2024

nov 29, 2024

nov 27, 2024

nov 27, 2024

nov 24, 2024

nov 10, 2024

ott 29, 2024

ott 21, 2024

ott 16, 2024

ott 11, 2024

ott 5, 2024

set 23, 2024

set 19, 2024

set 8, 2024

set 8, 2024

ago 27, 2024

ago 26, 2024

ago 22, 2024

ago 22, 2024

ago 8, 2024

lug 29, 2024

lug 19, 2024

mag 4, 2024

mag 4, 2024